Mortgage Blog

Quality advice, quality service and the best mortgage rates

Category: Finance (43 posts)

Down Payments Decoded: What Your Savings Mean for Homeownership in Alberta

April 30, 2025 | Posted by: Angela Robinson

Saving for a down payment is one of the biggest milestones toward owning a home — but how far your savings stretch depends a lot on where you buy! Here in Alberta, your down payment can go much ...

read moreNavigate your path to homeownership with strategic investments!

February 7, 2024 | Posted by: Angela Robinson

To buy your first home in Canada, determine your budget and save for a 20% down payment to avoid mortgage insurance. Consider the First Home Savings Account (FHSA), introduced in April 2023, with an ...

read moreConsolidate Your Debt and Save!

November 29, 2023 | Posted by: Angela Robinson

Are you burdened by high-interest rate debt, particularly from credit cards? Imagine a life where you can become debt-free sooner, increase your monthly cash flow, and reduce f ...

read more5 Habits People With Near Perfect Credit Scores Have

September 6, 2023 | Posted by: Angela Robinson

Have you ever wondered how some people achieve that perfect credit score of 800 or more? A recent LendingTree study analyzed 100,000 credit reports of Americans with exceptional credit scores and here ...

read morePayday Loans Are Borderline Criminal

May 3, 2023 | Posted by: Angela Robinson

A new study conducted by Hoyes, Michalos & Associates reveals that close to 100,000 Canadians, including nearly 35,000 Ontarians, filed a bankruptcy or consumer proposal in 2022, with almost ...

read moreGet The Cash You Need With A HELOC

April 26, 2023 | Posted by: Angela Robinson

Need cash for home renovations, debt consolidation, or a major purchase? Consider a Home Equity Line of Credit (HELOC). Unlike a traditional mortgage, a HELOC allows you to access funds up to a certai ...

read moreFirst home savings account: Banks say they’re not ready for an April 1 launch

March 29, 2023 | Posted by: Angela Robinson

A new savings vehicle for Canadians saving towards their first home purchase will technically be available starting April 1, but financial institutions who spoke to Global News say they won’t be ...

read moreMortgage Specials For Healthcare Workers!

March 15, 2023 | Posted by: Angela Robinson

As a healthcare worker, your selflessness, and tireless efforts to care for others deserve recognition and support. That's why the experts at Alberta Mortgage Professionals are dedicated to assist ...

read moreWhich is the best plan to save for your first house? The new First Home Savings Account, a TFSA, or an RRSP?

September 12, 2022 | Posted by: Marc Crossman

With housing prices still going through the roof, it’s not easy to save up enough for the down payment on your first house. The federal government recently created the Tax-Free First Home Savin ...

read moreCredit Scores and Interest Rates

August 29, 2022 | Posted by: Marc Crossman

Let's take a look at how your credit scores can impact interest rates when you apply for a mortgage. The chart shown illustrates how much your credit score affects the annual percentage ...

read moreHow to Get the Lowest Refinance Rate

August 15, 2022 | Posted by: Marc Crossman

Now may be a great time to refinance your mortgage! If you are considering a refinance, there are a few things you can do to help you earn the lowest possible rate: Make additio ...

read moreThe Worst Credit Card Mistakes You Should Stop Making

August 1, 2022 | Posted by: Marc Crossman

There are several important benefits of using a credit card to shop. You can earn rewards, build your credit and take advantage of points and perks. But while shopping with a credit card can be c ...

read more5 Reasons Why Refinancing your Home is a Good Idea

July 18, 2022 | Posted by: Marc Crossman

Thinking of refinancing your property? Find out why it’s a good idea below. What is Refinancing? Refinancing is when a bank or finance company buys out the mortgage on your property. C ...

read moreThree Ways To Get The Best Possible Mortgage Rate

May 23, 2022 | Posted by: Marc Crossman

When you qualify for a mortgage loan, you're going to end up paying tens of thousands of dollars in interest over the life of the loan. Thus, it’s important to do everything you can to get the b ...

read moreTransUnion's monthly subscription isn't cheap, but it could help you boost your credit score with personalized advice.

April 25, 2022 | Posted by: Marc Crossman

Your credit determines a lot in your financial life. It affects the interest rates you're offered and determines whether or not you'll get approved for a loan. On top of that, if your ...

read moreStop Looking for Shortcuts to a Better Credit Score

March 21, 2022 | Posted by: Marc Crossman

The secret to credit score management? Pay what you owe on time, and never borrow even close to the maximum amount lenders will give you. Do only that and you will not have a problem borrowing at a co ...

read moreGetting Pre-Qualified. Does it Work? Is it Worth it?

February 28, 2022 | Posted by: Marc Crossman

Getting prequalified is one of the first ways to find out how much mortgage you can afford. It is worth understanding exactly what a mortgage prequalification is, so here’s more. ...

read moreFront of The Line

February 14, 2022 | Posted by: Marc Crossman

Are you in one of the following frontline positions? Border services Correction officers Paid firefighter Paramedic Police officer Registered physician Registered nurse Registered Prac ...

read moreFour Ways To Use A Home Equity Loan

January 31, 2022 | Posted by: Marc Crossman

A home equity loan is a common tool that homeowners use to pay for various needs. Compared to other debts, home equity loans tend to have lower, fixed rates and the repayment period can b ...

read moreFour Smart Ways To Use A Home Equity Loan

January 24, 2022 | Posted by: Marc Crossman

A home equity loan, also known as a second mortgage, is a common tool that homeowners use to pay for various needs. Here are some smart ways to use them. Compared to other debts, home equity ...

read moreYour Preference When Arranging A Mortgage - Having Your Hand Held By A Nice Banker Or The Lowest Possible Rate?

January 10, 2022 | Posted by: Marc Crossman

A minority of people setting up, renewing, or refinancing mortgages are using mortgage brokers, check out the article below and find out why you should be too If you are looking for a broker ...

read moreAccess Funds With A Reverse Mortgage

January 3, 2022 | Posted by: Marc Crossman

In 2020, as Canadians spent more time at home, there was a boom in home renovations. Reverse mortgages can offer a helpful option for those costly renovations. Read the full article below to find out ...

read moreIs It Time For You To Buy Or Refinance?

December 20, 2021 | Posted by: Marc Crossman

Are you considering buying a new home or refinancing your current mortgage? The decision to get or refinance a mortgage is a big one – but you're not alone. There are many potentia ...

read moreHow to fine-tune your finances for a mortgage

December 13, 2021 | Posted by: Marc Crossman

Experts such as our very own Marc Crossman, managing partner and mortgage broker at Mortgage Alliance Lending Advisors, say that new mortgage rules and the potential for rising interest in the comin ...

read moreThe Smith Manoeuvre strategy and how to use it — the right way — to your advantage

October 25, 2021 | Posted by: Marc Crossman

The Smith Manoeuver is among many strategies you may not be familiar with. Alberta Mortgage Professionals can provide many options such as this to help guide you through your home ownership journey. ...

read moreWhat does Today's Bank of Canada decision mean for consumers?

October 18, 2021 | Posted by: Marc Crossman

The Bank of Canada has decided on how to move forward regarding interest rates amid the ongoing pandemic, read the full article below and contact us today to find out how you may be able to take adv ...

read moreHow and Why to Cancel a Credit Card, Without Destroying Your Credit Score

October 4, 2021 | Posted by: Marc Crossman

While cancelling credit cards may seem to make your life easier, there are some complications to consider.Canceling can hurt your credit score and affects your credit in two ways:· & ...

read moreCash-Out vs. HELOC Refinancing

September 13, 2021 | Posted by: Marc Crossman

If you’re interested in borrowing against your home’s available equity, you have choices. Some options are to refinance and get cash out, or to take out a home equity line of credit (HELOC ...

read moreWhy You Should Get Pre-Approved Before June 1, 2021

August 2, 2021 | Posted by: Marc Crossman

The Canadian Banking Regulator, Office of the Superintendent of Financial Institutions (OSFI) gave guidance that they were planning on tighten mortgage qualification for uninsured mortgages. OSFI sugg ...

read moreWhat About Rates?

July 26, 2021 | Posted by: Marc Crossman

You have probably heard that the COVID-19 pandemic has had an effect on mortgage rates over the past year and you might be curious how this impacts your financial situation. Have you ha ...

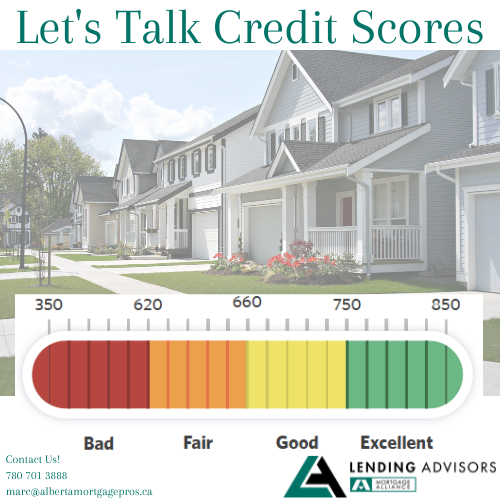

read moreLet's Talk Credit Scores

July 12, 2021 | Posted by: Marc Crossman

Your credit score is a number between 300-900. Anything above 700 shows that you have managed your money well and are a good candidate for a mortgage. A score between 600-700 means th ...

read moreThe Role of a Mortgage Broker

July 5, 2021 | Posted by: Marc Crossman

The Role of a Mortgage Broker Across Canada the housing market has continued to expand, despite the pandemic. This has been attributed to a lack of inventory and the low cost of debt have com ...

read moreWhat is a central bank?

May 3, 2021 | Posted by: Marc Crossman

Sep 23, 2019Created by First National Financial LP As we head into the federal election we’ll be hearing a lot about the economy, interest rates and housing. In this country, one of the ...

read moreWHERE ARE CANADIAN MORTGAGE RATES GOING IN 2018?

February 15, 2021 | Posted by: Marc Crossman

2017 was a year of change for the Canadian Mortgage Market. With the announcement of the B-20 guideline changes requiring all insured or uninsured mortgages to undergo stress testing. In addition, the ...

read moreTIPS FOR YOUR VARIABLE RATE MORTGAGE THAT COULD SAVE YOU THOUSANDS

January 18, 2021 | Posted by: Marc Crossman

With changes to mortgage rules and interest rates on the rise here are some tips for your variable rate mortgage that could save you thousands. Since 2009 the prime lending rate has shifted f ...

read moreWHAT IS THE CANADIAN MORTGAGE AND HOUSING CORPORATION (CMHC)?

November 30, 2020 | Posted by: Marc Crossman

The Canadian Mortgage and Housing Corporation (CMHC) is a corporation that most are semi-familiar with, but do not know what CMHC actually does. CMHC is Canada’s authority on ho ...

read moreIS IT TIME TO LOCK IN A VARIABLE RATE MORTGAGE?

September 21, 2020 | Posted by: Marc Crossman

Approximately 32 per cent of Canadians are in a variable rate mortgage, which with rates effectively declining steadily for the better part of the last ten years has worked well. Rece ...

read moreOSFI MORTGAGE CHANGES ARE COMING

September 7, 2020 | Posted by: Marc Crossman

As many of you may remember, this past October the Office of the Superintendent of Financial Institutions (OSFI) issued a revision to Guideline B-20. The changes will go into effect on Ja ...

read moreHOW MORTGAGE RATES WORK

May 18, 2020 | Posted by: Marc Crossman

Ever wonder how your mortgage rate is determined? What factors make it jump from percentage to percentage? We are getting down to the nitty gritty today and giving you the facts on what impact ...

read moreFINANCE MINISTER MORNEAU TAKES OUT THE BIG GUNS TO SLOW HOUSING

August 5, 2019 | Posted by: Marc Crossman

Yesterday, Ottawa unveiled major initiatives to slow housing activity both by potentially discouraging foreign home purchases and, more importantly, by making it more difficult for Canadians to get mo ...

read moreCanada Starts to Outperform the U.S.

April 1, 2019 | Posted by: Marc Crossman

Crude oil prices are poised for their biggest monthly gain in seven years, hitting a new high for 2016, and as day follows night, the Canadian dollar is up sharply--just shy of 80 cents U.S. T ...

read moreBudget 2016 Billed As Growing the Middle Class

January 7, 2019 | Posted by: Marc Crossman

Today’s budget included everything I expected and nothing that I feared. The fears first—there is no change in the tax treatment of capital gains or stock options, despite continue ...

read moreFINANCIAL CHECK-UP

July 23, 2018 | Posted by: Marc Crossman

Welcome to your free financial check-up, discussing 5 key factors to assist you in ensuring you are on the right track to a solid financial future. Credit Ensuring you are using credit wisel ...

read more

.png)